PERSPECTIVESon retirement plan conversions

PERSPECTIVES

The decision to change retirement plan services provider is among the most important and potentially fraught decisions a plan sponsor can make. A successful plan conversion requires extensive planning, precision accuracy, and frequent communications between teams of experts who will manage the process. While a plan conversion may be overwhelming to any plan sponsor, it is especially true for a plan sponsor with no previous experience working through a plan transition. And it does not matter if the defined contribution plan has $1 million in assets or $100 million or even $1 Billion.

The last thing a plan sponsor wants (or any of the key stakeholders involved in a retirement plan conversion want) is a transition that causes undue stress and is full of surprises. What a plan sponsor does want is a quality transition - predictable, planned and process - driven.

Perspectives On Quality Transitions

Look inward first.

Before a plan sponsor decides to choose a new provider for their retirement plan there are a myriad of possible decisions and topics to review. A potential transition provides an opportunity to do things like review plan design, verify that the plan is being administered according to the plan document and verify who will need to formally sign off on any proposed changes. There may be many reasons to switch providers, but there is only one goal: to have a successful, stress-free transition from one service provider to another. And all the key stakeholders—from the recordkeeper to the advisor to the payroll provider— all share this goal.

Details. A transition is a series of small and large decisions made steadily throughout the process. So, understanding the specifics and recognizing the impact of those specifics on the overall transition is critical. In order to do that, Plan Sponsors need to judge the impact of certain details on the overall process.

For this publication, we looked at how different factors impact (or don’t) the amount of time or attention to detail is needed during service provider transitions for five scenarios. Look for this call out box to see the results.

The decision to change retirement plan services provider is among the most important and potentially fraught decisions a plan sponsor can make. A successful plan conversion requires extensive planning, precision accuracy, and frequent communications between teams of experts who will manage the process. While a plan conversion may be overwhelming to any plan sponsor, it is especially true for a plan sponsor with no previous experience working through a plan transition. And it does not matter if the defined contribution plan has $1 million in assets or $100 million or even $1 Billion.

The last thing a plan sponsor wants (or any of the key stakeholders involved in a retirement plan conversion want) is a transition that causes undue stress and is full of surprises. What a plan sponsor does want is a quality transition - predictable, planned and process - driven.

Perspectives On Quality Transitions

Look inward first.

Before a plan sponsor decides to choose a new provider for their retirement plan there are a myriad of possible decisions and topics to review. A potential transition provides an opportunity to do things like review plan design, verify that the plan is being administered according to the plan document and verify who will need to formally sign off on any proposed changes. There may be many reasons to switch providers, but there is only one goal: to have a successful, stress-free transition from one service provider to another. And all the key stakeholders—from the recordkeeper to the advisor to the payroll provider— all share this goal.

Details. A transition is a series of small and large decisions made steadily throughout the process. So, understanding the specifics and recognizing the impact of those specifics on the overall transition is critical. In order to do that, Plan Sponsors need to judge the impact of certain details on the overall process.

For this publication, we looked at how different factors impact (or don’t) the amount of time or attention to detail is needed during service provider transitions for five scenarios. Look for this call out box to see the results.

Bring things into focus

Many factors will help secure a successful transition for a retirement plan. The focus is always on the details and accuracy of the data. The selected provider should provide a timeline for key milestones and events The timeline must incorporate regulatory requirements, including Sarbanes-Oxley (SOX) notices, fee disclosures, and any other participant notices regarding the conversion.

There are proven success factors that if adhered to will ensure a quality and seamless transition. The first and most critical is integration of the payroll systems. Information from the current payroll provider is inherently required for plan conversion success.

1. Submit a formal notice to current payroll provider. The first of these seems basic but it should not be overlooked. A plan sponsor must be sure to give the payroll provider a formal, written notice that the plan service provider will change. Be sure to follow the agreement details within the previous recordkeeper or administrator contract, beginning with the termination notification period.

2. Submit a formal notice to current recordkeeper. This step also seems basic but it is pivotal. This begins the process of deconversion.

3. Finalize investment selection. The selection of plan investments must be finalized before participant communications can be developed, scheduled and delivered. (This should be documented as part of the overall transition timeline.) The final selection of investment options is a critical step in the process and includes the mapping strategy to inform participants where their assets will be invested. It impacts all aspects of the transition and informs plan communication and education strategies and campaigns.

4. Ensure that all documents are prepared. As the sponsor may ask the plan advisor or another party to verify calculation of compensation (as defined by the plan) for the first payroll feed after implementation, for the first year (cumulative to verify annual bonuses and incentive compensation) and annually thereafter. While seemingly unnecessary, this extra verification process could alleviate significant issues ongoing.

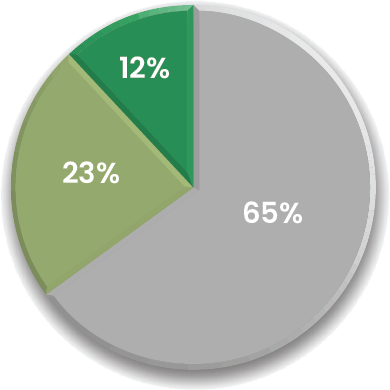

Scenario 1

The average account balance for the case is lower than usual

How much attention to details is needed in the service provider transition

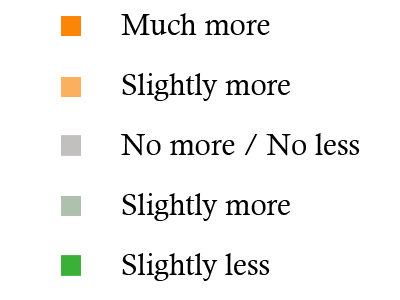

Scenario 2

The QDIA is changing in the transition to the new service provider

Scenario 3

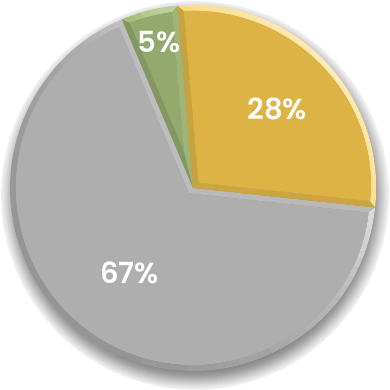

The HCM / Payroll platform is changing around the time of the service provider transition

How much attention to details is needed in the service provider transition

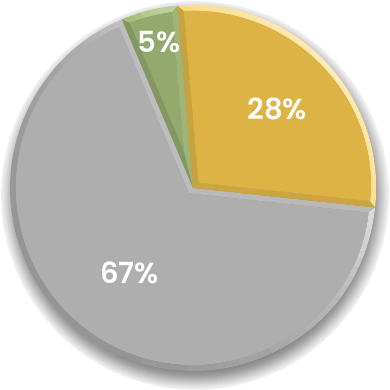

Scenario 4

Email addresses are missing for more than half the participants

5. Be aware that test files will be requested. The incoming recordkeeper will typically request the test files from the prior recordkeeper early in the process to verify file format and quality, long before the actual transfer of records. It is important that the payroll system is in sync with the new recordkeeper..

6. Engaging participants. Developing and implementing a participant engagement strategy that will include touchpoints at critical junctures is essential. It is a regulatory requirement that participants receive notices and other information in a timely matter. This process must be informative and action-oriented so that plan participants assess their personal situation and can make new salary deferrals and investment selections if required. Most recordkeepers have some sort of standardized program for communication during a transition. It may be wise, however, for plans with fewer assets to work with their advisor and recordkeeper to determine the most beneficial omnichannel strategy for communications with their employees.

Through the plan sponsor lens

Ultimately, the plan sponsor as fiduciary is responsible for the status of the retirement plan. Before beginning any conversion process, consult your legal counsel and your professional retirement plan advisor. An implementation causes the formation of a “team” comprised of representatives from all the involved stakeholders (advisor, recordkeeper, payroll provider, prior recordkeeper and of course, the plan sponsor). The implementation lead (new recordkeeper) will develop and share a calendar of key events and dates. Regular calls will be scheduled to enable effective communication with the entire implementation team throughout the multiple stages of the conversion timeline.

Trying to maintain perspective.

The timeline/schedule of events is intended to maintain and preserve a smooth, quality transition. However, there are certain events that can interrupt that schedule. This list is not complete, but does provide insight into the kind of actions that can put a quality implementation at risk:

-

Imprecise investment decisions. The choice of investment menu is one of the most critical decisions a plan sponsor has to make.

-

Differences in service agreements- Remember the previous and current recordkeepers do not use the same agreements. Additionally, the current recordkeeper and the incoming recordkeeper must agree on the de-conversion or conversion date. So, this may add another layer of complexity to the conversion timeline/schedule.

-

Missing data, and inconsistencies with the test file from the prior service provider,

-

Poor quality payroll test files,

-

Excessive cost of test payroll files,

-

Mergers and acquisitions and other corporate actions.

Look at it another way

There is no doubt that you can manage through the conversion process. Patience, teamwork, open communication, and attention to detail can help the plan sponsor successfully navigate through the various stages of a plan conversion. The relationship with the new recordkeeper really begins at this moment. The stage will be set for a successful business relationship moving forward.

How much attention to details is needed in the service provider transition

Scenario 4

The plan sponsor does not have a dedicated retirement plan administrator on staff

STAGE ONE

Assign set-up, conversion, and payroll specialists for the working team, review documents, request asset allocation models, request fee disclosures, and mapping grid, implementation meetings, strategy development of the employee engagement Communications & Education plan, and the preparation of enrollment kits. Create employee notices and other employee communications. Conversion call with key team members.

STAGE TWO

Multiple conversion calls, transition set-up on new recordkeeping system, order enrollment materials, welcome letters written and produced, census file complete, plan set-up complete, mail welcome letters.

STAGE THREE

Multiple conversion calls, loan salary deferrals, WEB IVR set-up, final payroll file, deliver final conversion files, conduct final audit, site training, participant conversion re-enrollment meeting, group transition team meeting, mapping of assets, assets wired,

GO LIVE

STAGE ONE

Assign set-up, conversion, and payroll specialists for the working team, review documents, request asset allocation models, request fee disclosures, and mapping grid, implementation meetings, strategy development of the employee engagement Communications & Education plan, and the preparation of enrollment kits. Create employee notices and other employee communications. Conversion call with key team members.

STAGE TWO

Multiple conversion calls, transition set-up on new recordkeeping system, order enrollment materials, welcome letters written and produced, census file complete, plan set-up complete, mail welcome letters.

STAGE THREE

Multiple conversion calls, loan salary deferrals, WEB IVR set-up, final payroll file, deliver final conversion files, conduct final audit, site training, participant conversion re-enrollment meeting, group transition team meeting, mapping of assets, assets wired,

GO LIVE

REQUIRED DOCUMENTS

- Complete list of investment options in the NEW investment line up.

- Signed plan adoption agreement Fund mapping of account balances,

- Basic plan documents

- Recent plan-level statement and investment allocations

- Executed services agreement, Recent favorable IRS determination letter

- Description of payroll feed Recent discrimination testing results

Every implementation is a scheduled event. But each implementation is unique. In all implementations however, there are three stages of the process. The chart below is not intended to be a complete listing but it is intended to show the complex dependencies and how a delay in finalizing any one of these could negatively impact the transition quality.

The conversion process can last between 90-120 days. Ensuring that the right team is focused on the right milestones and objectives will ensure the quality transition with minimal pain points. Communication is key. The incoming recordkeeper needs to understand the plan sponsor’s internal decision process requirements, required sign-offs, and time needed so all milestones can be incorporated into the timeline. This list below may serve to help clarify roles, responsibilities, timing and relationships. Consider:

|

|

REQUIRED DOCUMENTS

-

Complete list of investment options in the NEW investment line up.

-

Signed plan adoption agreement

-

Fund mapping of account balances,

-

Basic plan documents

-

Recent plan-level statement and investment allocations

-

Executed services agreement,

-

Recent favorable IRS determination letter

-

Description of payroll feed

-

Recent discrimination testing results

Every implementation is a scheduled event. But each implementation is unique. In all implementations however, there are three stages of the process. The chart below is not intended to be a complete listing but it is intended to show the complex dependencies and how a delay in finalizing any one of these could negatively impact the transition quality.

The conversion process can last between 90-120 days. Ensuring that the right team is focused on the right milestones and objectives will ensure the quality transition with minimal pain points. Communication is key. The incoming recordkeeper needs to understand the plan sponsor’s internal decision process requirements, required sign-offs, and time needed so all milestones can be incorporated into the timeline. This list below may serve to help clarify roles, responsibilities, timing and relationships. Consider:

-

Weekly touch base calls with appropriate internal team members and recordkeeper transition team—usually lead by the implementation lead at the new recordkeeper

-

Include payroll department in early discussion(s) to ensure understanding and engagement for correct file set-up and transmittal management.

-

Early in the process, connect internal IT/systems team members with recordkeeper counterpart to outline necessary specs and system alignment.

-

Clarify team member ‘ownership’ and accountability for various phases of transition

-

This is a great opportunity to do a portfolio ‘refresh’ with the plan advisor to ensure appropriate asset classes, share classes, and any additional investment products are considered. (e.g. retirement income, SDBA, etc.)

-

Leverage recordkeeper employee education tools, technology and available onsite support to maximize employee engagement.

New perspectives and better outcomes

How is a quality transition defined? And what is the impact of a transition on the client experience? It is an ineffable combination of teamwork, data, patience, and dedication. A quality client experience is about getting the plan to GO (good order) status at the time of the transfer of records. And a quality transition is in very large part dependent upon the quality of data received.

-

The recordkeeper’s responsibility is to communicate with all stakeholders, keep the client informed, and the transition on schedule.

-

The advisor’s responsibility is to support the plan sponsor—especially when it comes to investment selection, mapping of assets and other investment product related decisions.

-

The plan sponsor’s responsibility is to have the right advisor on board, be flexible and open to new ways of doing things.

A new perspective can be the difference between a transition and a quality and successful transition.

Perspectives is part of the Viewpoint series of publications.

© EACH Enterprise, LLC 2023 All rights reserved.

New perspectives and better outcomes

How is a quality transition defined? And what is the impact of a transition on the client experience? It is an ineffable combination of teamwork, data, patience, and dedication. A quality client experience is about getting the plan to GO (good order) status at the time of the transfer of records. And a quality transition is in very large part dependent upon the quality of data received.

- The recordkeeper’s responsibility is to communicate with all stakeholders, keep the client informed, and the transition on schedule.

- The advisor’s responsibility is to support the plan sponsor—especially when it comes to investment selection, mapping of assets and other investment product related decisions.

- The plan sponsor’s responsibility is to have the right advisor on board, be flexible and open to new ways of doing things.

A new perspective can be the difference between a transition and a quality and successful transition.

Perspectives is part of the Viewpoint series of publications.

© EACH Enterprise, LLC 2023 All rights reserved.